On the one hand, NETFLIX adds 22 m subscribers in 2017, 29 m in 2018 and more than 12 m in the first half of 2019. On the other hand, cable operators have lost video subscribers in recent years and the trend continues: in the first half of 2019, CHARTER lost 286,000 subscribers, AT&T 1.3 million, VERIZON 105,000 and COMCAST 345,000. Internationally, the picture is not much more encouraging: LIBERTY GLOBAL, the European leader, is losing 120,000 subscribers. The decline seems inexorable.

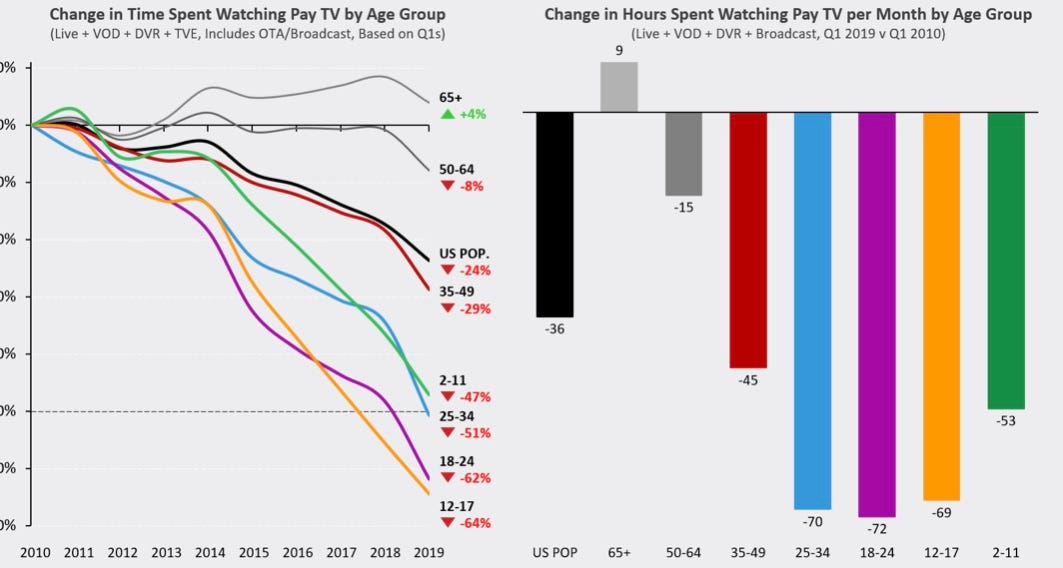

The following graph relayed by Matthew Ball (MEDIAREDEF) shows the growing lack of interest in traditional TV:

If people are no longer interested in pay TV, it makes sense for them to cut the cord. If they have not already done so, they will do so because attention is a leading indicator. The pace is even expected to accelerate, with disinterest worsening. Traditional TV represented by channels such as CBS, DISCOVERY, NBC, ESPN, etc. seems to be condemned with a lack of interest, especially among the younger generations who prefer YOUTUBE, NETFLIX or FORTNITE.

ROKU presents another facet of reality: this company allows its users to watch the content they like in streaming (on the internet) from their TV. If it is a smart TV, it only needs to be equipped with the ROKU operating system (25% of new smart TVs in the United States) otherwise, a special remote control is required. ROKU is a tool for streaming any TV channel. ROKU is a resounding success: 41 million devices already operate with the ROKU OS in the United States compared to 15 million three years ago and the number of users is growing at high speed: 30.5 million users in the second half of 2019, up 39% over one year. The number of streaming hours increased by 72% over the same period. ROKU transmits many traditional linear channels, i. e. with predefined programs, in addition to YouTube and NETFLIX. It is the free channels financed by advertising that work best on OS ROKU, as explained in 10 K 2018:

AVOD (advertising video on demand) is our fastest growing distribution model, and we are increasing the monetization of these hours by increasing our advertising capacity on and off the Roku platform.

If ROKU capitalisation has increased fivefold in two years, it may be a sign after all that traditional TV, made up of good old linear channels, is not dead. So what is it really like?

The Internet, by greatly facilitating access to goods and services, provides abundance. As a result, many professions in the world before that thought they were bringing abundance to their customers are now in turmoil. WAL MART, for example, had developed a very complex inventory optimization system that offered more than 100,000 products per store at low prices. It seemed difficult to do better. However, AMAZON arrives and offers in 2018... 560 million products... What AMAZON offers with products, GOOGLE does with information, FACEBOOK with contacts and NETFLIX with films and series. The traditional packages marketed by cable operators include 100 to 200 channels, i.e. 100 to 200 simultaneous programmes. These programs can only be viewed by the cable installed in the house. Until the advent of the Internet, it was abundance. Just as WAL MART is limited by the territory where its stores are located, TV packages are limited by the territory where the cable is laid. NETFLIX offers him a catalogue of more than 5,000 titles simultaneously, available on any screen, without any territorial contingency... and at a price 10 times cheaper. What a difference!

A small basic strategic rule: to succeed, you must avoid having the same economic proposal as the other one that is not as good. Yet this is what many businesses have been driven to by the Internet when they offered abundance: supermarkets, printing press, encyclopedias, business computing, etc. TV packages are victims of the same evil. It is hard to believe that they can resist an OTT offer like NETFLIX, AMAZON or DISNEY PLUS. The response of cable operators and some other actors is to create virtual skinny bundles. These have proliferated in recent years: SLINGTV, DIRECTVNOW, YOUTUBE TV, HULU WITH LIVE TV, etc. Such a strategy has only one interest: to lower the price of the bundle. Strategically, the skinny bundle is not the solution to compete with NETFLIX:

it is certainly cheaper than a classic 200-channel package but still much more expensive than a NETFLIX subscription

it limits even more the choice than the traditional bundles (20 to 25 channels)

the fact that it is virtual is a plus compared to a bundle linked to a territory, but does not provide anything compared to an OTT offer.

The bundles are therefore attacked by the Internet whatever their form. What about their underlying, the chains themselves?

The problem of TV channels, with the Internet, is access to distribution. According to the definition of BEN THOMSON Stratechery , Internet aggregators, by providing an abundance beyond what existed before, create a very strong link with their users. They then become an essential step for suppliers who want to reach users. The offer is then pushed at the gate, which attracts new users, reinforcing the network effect. Controlling demand, the aggregators then disintegrate the supply into elementary particles, which can be replaced as desired. The competitive advantage lies in the ability to guide the user in his choice... and this advantage becomes enormous. The typical illustration is NETFLIX. The range of films and series is far from what was previously available (basic or premium channels such as STARZ or SHOWTIME) and can be watched easily. This attracts subscribers, which allows NETFLIX to further enrich its catalogue and thus attract new subscribers. In this jungle of programs, NETFLIX has designed an algorithm that allows to choose the most suitable films for subscribers according to their tastes. Tastes prevail over actors, directors, production companies that are modularized. The competitive advantage is in the algorithm more than in the quality of the films (even if the latter helps)

Traditional channels, on the other hand, live on the quality of their programming. They have no place in the NETFLIX universe, which considers that subscribers are able to make their choices guided by the right algorithm: NETFLIX deprives channels of their raison d'être to buy or design programs directly. The old ecosystem is completely disintermediated by NETFLIX, which catches the subscriber, commits him to stay as long as possible on the application (1 hour per day already, a third of traditionnal TV). NETFLIX is gradually becoming TV with program spending of $15 billion per year!

VIACOM is a case study of what can happen to a company not prepared to face the Internet: destruction. In the 1980s, VIACOM had focused on young people, particularly through its MTV channel, which broadcast music videos. The content was bold at the time and had succeeded in breaking through despite the prevailing scepticism. With the Internet, YOUTUBE has brought the abundance of clips and made MTV obsolete. Faced with the decline in audience, management reacted by increasing the number of advertisements and massively buying back VIACOM shares, which were overvalued. The result was catastrophic for the group: the share price went from $90 in 2013 to $25 in 2019. However, the VIACOM case should not be generalized.

Indeed, careful observation of the dynamics of the Internet shows that traditional channels can thrive if they are renewed:

Aggregators literally kill their suppliers by preventing them from building their customer relationships. The latter should consider themselves lucky to be able to sell more on condition that they pay the rent (example: AMAZON marketplace). AMAZON's recent reaction to the GAFA tax decided by France is revealing in this respect: passing the tax on the marketplace ‘s vendors. This is the Achilles' heel of aggregators: they capture the customer in an almost monopolistic way and feed on the suppliers they put in competition for access to the monopoly. This gives an opportunity to real platforms that allow their users to differentiate themselves. Thus SHOPIFY offers an alternative to AMAZON or ROKU an alternative to NETFLIX. It is not surprising that these two platforms have met with considerable success: they maintain neutrality between companies and their customers, just helping them to do more business. These platforms are limited to the role of a tool.

The choice and selection of programs (daily bread of traditional channels) has a future. Indeed, people like to be guided in their choices and not necessarily choose everything themselves. They also need curation by other people they value: influencers. This explains the success of the HOWARD STERN SHOW on SIRIUS or the OPRAH WINFREY channel promoted by DISCOVERY but also many influencers channels on YOUTUBE. The overabundance of choices can lead to anxiety, regret, etc. This psychological risk was addressed by ALVIN and HEIDI TOFFLER in their book LE CHOC DU FUTUR written in 1970. The best of all worlds is therefore a balance (50/50) between the possibility of choice and curation.

People also need to get together around live events (concerts, sporting events, etc.). This social aspect is much better promoted by traditional TV than by NETFLIX.

The problem is that most TV channels have been designed to integrate bundles. The principle of the bundle is mutualisation: subscribers motivated by sport pay less than if they only subscribed to sport because other subscribers of the bouquet, less motivated, subsidise them. However, the latter agree to do so because the former also pay for the channels they prefer. In total, bundles subscribers are happy with a second choice offer at a moderate price. This does not push the channels to excellence. However, the Internet pushes for excellence, it is the opposite logic. Since you can find what you want there, you look for exactly what you need, not the second choice. As a result, channels must strive to differentiate themselves as much as possible, by uniting fans around a highly targeted and high-quality offer, and by forming a specialized social network. By having a direct relationship with its subscribers, the linear TV channel can bypass aggregators, break into a niche and monetize its audience in a differentiated way.

Here is what DAVID ZAZLAV, CEO of DISCOVERY, said about the possibilities of monetization in his latest conférence call:

So you can watch Fleabag, which by the way is one of the - is one of the all three production companies, and one of the big hits on Amazon. So all you can do is view it. That's great. You can view it and laugh or cry but that's it. You just view it.

Our content has a real ability to view and do or view and transact. So imagine a world where you've got a lot of people fighting for subscribers that people pay a monthly fee for and all they can do is view but our content has subscribers but they can also transact. That's true in food, it's true in home, it's true in Golf, it's true in cycling, and if you go back to the world that Malone helped create in terms of full circle,100 channels, and then he has HSN and QVC that he owned but in running QVC and HSN and creating a lot of shareholder value along the way, it was, it's completely inefficient and a lot of the people that were on food at home were going over and trying to get an audience to come over and spend time with them on QVC or HSN and buy stuff.

Stuff that they really wanted that needed to be - that they wanted to know what is the - what's the best, what's the best kitchenware. And so what we can do over time and we're fighting like hell to do it is if we can aggregate these passion groups, not only are they going to view with us, but they're going to be able to do with us.

DISCOVERY thus creates affinity TV channels in cycling, golf, ready meals, home decoration, etc. in order to win fans with proprietary programming. The direct link with the customer creates goodwill: this is the key. Thus, despite competition from NETFLIX, DISCOVERY's turnover continues to grow, although its channels are still largely included in the bundles (skinny or not). But what is lost on one side (cord cutting) is largely compensated on the other by the direct offer on different platforms.

The CBS group is also an example of a good reaction to the Internet threat: CBS does not seek to embrace everything but on the contrary to position itself where aggregators have weaknesses: it stratifies its clientele between 1/ seniors with its main channel (as can be seen in the graph at the top, only seniors watch more traditional TV) 2/ the youngest (18/49 years old) with a targeted proprietary OTT offer (CBS ALL ACCESS) and quality programming from sport to series. The recent merger announced with VIACOM will enhance CBS ALL ACCESS' appeal to young people by adding many hours of original programming. This stratification is the opposite of the AMAZON PRIME VIDEO, TIME WARNER, APPLE, NBCUNIVERSAL which are aimed at everyone and therefore seek the same type of content with a high potential audience rate, raising the bar on the production costs of series.

Traditional TV still has a bright future ahead of it, provided it plays the niche strategy (s), consolidates it by building a specialized social network and leaves the big cavalry to NETFLIX or YOUTUBE.