Masters of time

From CNBC (November 6, 2019):

Netflix has built itself into a $125 billion company by accumulating global subscribers -- a number that reached about 160 million when the company announced third-quarter results last month.

But CEO Reed Hastings said Wednesday that subscriber counts aren’t the right metric to track who’s winning the streaming wars -- what’s really important is how viewers spend their time.

“Time will be the real competition,” Hastings said at the New York Times DealBook Conference in New York City. “You’ll hear some subscriber numbers but you can just bundle things so that’s not going to be that relevant. So the real measurement will be time -- how do consumers vote with their evenings? What mix of all the services do they end up watching?”

In his remarkable book, Rethinking the Economics of Land and Housing, Josh Ryan-Collins shows how exclusive real estate is. A piece of land is a unique, non-reproducible piece of land, a monopoly on space. Space is useful, even necessary for the vital needs of man and his economic activity. If we add to it, according to René Girard's mimetic theory, the power to own an inimitable good (for example with a sea view), the object of others desire, real estate is really valuable. These attributes of space are opposed to everyday consumer goods, standardized and reproducible objects, in particular digital goods that we are inundated with. Here's what I wrote in this article:

A real estate property is indeed unique, not by its construction but by its location. Each parcel of space is unique and therefore cannot be substituted for another identical one. However, it is easy to see that ownership of real estate is universally desired:

In feudal times, the excluded sought to gain land ownership rights, usually vested in kings and the church, and then to cement them by taking control of parliaments. Closer to home, after the Second World War, the rate of home ownership increased considerably. It can even be said that this desire to own one's home at all costs was a primary cause of the 2008 crisis, the "subprime" crisis.

Real estate (and the underlying land) are not the only highly valued monopolies on the market. Luxury products appeal due to their artisanal side, also because they are not reproducible identically: Hermes with its workshop in Pantin, Ferrari with its factory in Maranello, etc. sell unique products. Monopolies are worth very high prices: Ferrari at P / e 37, Hermes 48, etc.

There is still an exclusive, indispensable and misunderstood good for sale: time. It is probably the arbitrage of the century.

Time, an undervalued monopoly

Time is not reproducible. It is indispensable for all human activity: from gestation to education, to progress, etc. Paradoxically, while it is the unique and most necessary good, it is very undervalued in the minds of people. Price of time is ridiculous.

Take the example of one of the big investors of the planet: Warren Buffett. Each year he auctions two to three hours of his time. The last bid was $ 4.5 million, the previous record of 2016 at $ 3.5 million was beaten! Assuming that Berkshire Hathaway valuation is up 15% on average (past was 20%), the value created by Warren Buffett is $ 80 billion, or $ 9 million per hour. If the auctioned lunch lasts two hours, its value is $ 18 million and three hours $ 27 million. Even Warren Buffett brade his time!

Why we need to be interested in the media business

Médias are in the business of buying and selling your time. They make an arbitrage! It is difficult to find a more lucrative arbitrage: good deals are made at purchase. That's why big investors like John Malone have put their strategy on investing in the media business. His views on the evolution of the market are always interesting to listen to. Jeff Bezos bought the Washington Post and created Amazon Prime Video. Warren Buffett is also interested in media companies, his current investments in Charter Communication and Liberty Media Group companies are proof.

How is this arbitrage structured? Médias buy your time with content. It must then be monetized. There are two traditional ways:

The first is to make you pay for not reselling your time. The value of time being misunderstood, the price is cheap, but enough to make a good margin. Take the TV market. The pay-TV market is worth $ 100 billion. It's a very small market. Knowing that there are 700 million subscribers to pay channels that watch television 5 hours a day, the rate is 8 cents per hour per subscriber for not bothering you.

The second method is selling a small amount of your time to push positive messages about products (ads). This market is $ 200 billion, double the pay TV.

To sum up, the market of time is a small portion of global GDP. Worldwide ad expenditures are estimated at only $ 700 billion. If all forms of media are added, the market is worth a $ trillion maximum.

A little history of the market of time

Due to physical constraints, throughout the 20th century, creation and access to content was limited: a network of local correspondents was needed to glean information, very expensive equipment to film, etc. Newspapers had to be transported to arrive under the doors at the same time at the beginning of the day, wireless signals were limited on a frequency band, etc. Media companies created a barrier to entry. Those who had access were the only buyers of your time, which is always good to get a good deal. They traded time for cheap content.

Gradually, the number of access roads increased. In the 1980s and 1990s, cable made its mark by changing the TV business model, making it pay for more exclusive content. Time was then paid a little more, with cable competing with terrestrial. To improve monetization, cable operators have invented the bundle. This technique is remarkable for making consumers believe that they are getting more than their money's worth and making them satisfied, and therefore sustainable, customers. We will come back a little later on this technique which is changing the game on the monetization of time.

Then came the Internet with a shared infrastructure, no longer channeled by a few media groups... Suddenly everyone can reach you, fight for your time, its price can only rise... unless... there is more time for sale: since the invention of the smartphone, 95% of your waking time is online!

Time remains underrated ...Warren Buffett was wrong

Warren Buffett had anticipated the rise in the price of time since the early 1990s (symmetrically the decline in the value of content). In his annual letter to Berkshire Hathaway shareholders in 1991, he provided a media analysis, of which the following is an extract:

Until recently, media companies had all three characteristics of a franchise and, as a result, could charge high prices while being poorly managed. Now, however, consumers seeking information and entertainment (their main interest being the latter) have much wider choices about where to find it. Unfortunately, demand cannot increase in response to this new offer: 500 million American eyeballs and a 24-hour day, we cannot go beyond that. As a result, competition has intensified, markets have fragmented and the media industry has lost much of its appeal.

He concluded that it was better to get out of the industry. In 1990, two of his largest listed investments were Capital Cities/ABC and the Washington Post, he also owned the Buffalo News. In 2000, it held only an interest in the Washington Post and today the two small investments mentioned above. Warren Buffett underestimated three things:

Even if the price paid for time was destined to rise, the ability to monetize it was barely scratched. So even with a reduction in the time spent on a media, it may well have a flourishing future.

The time for sale was also going to increase significantly. The invention of the smartphone changed the game, significantly increasing screen time. Suddenly, almost 8 billion people put this time up for auction, so there are places to take... and not necessarily for those who have the most money. It is estimated that there are 1.6 billion TVs worldwide and 4.5 billion smartphones. Even if the smartphone is a little less popular than TV, the time on screen has at least doubled in the last 10 years.

Targeting would also be much better, capturing people's attention with less financial waste by optimizing the programs provided. It's like with wine: no need to take the best if the blend with the menu is perfect.

As a result, the unit price of time has decreased (cost of programmes/minutes viewed), monetization opportunities have increased, creating an unprecedented arbitrage opportunity for the media business.

The example of TV advertising

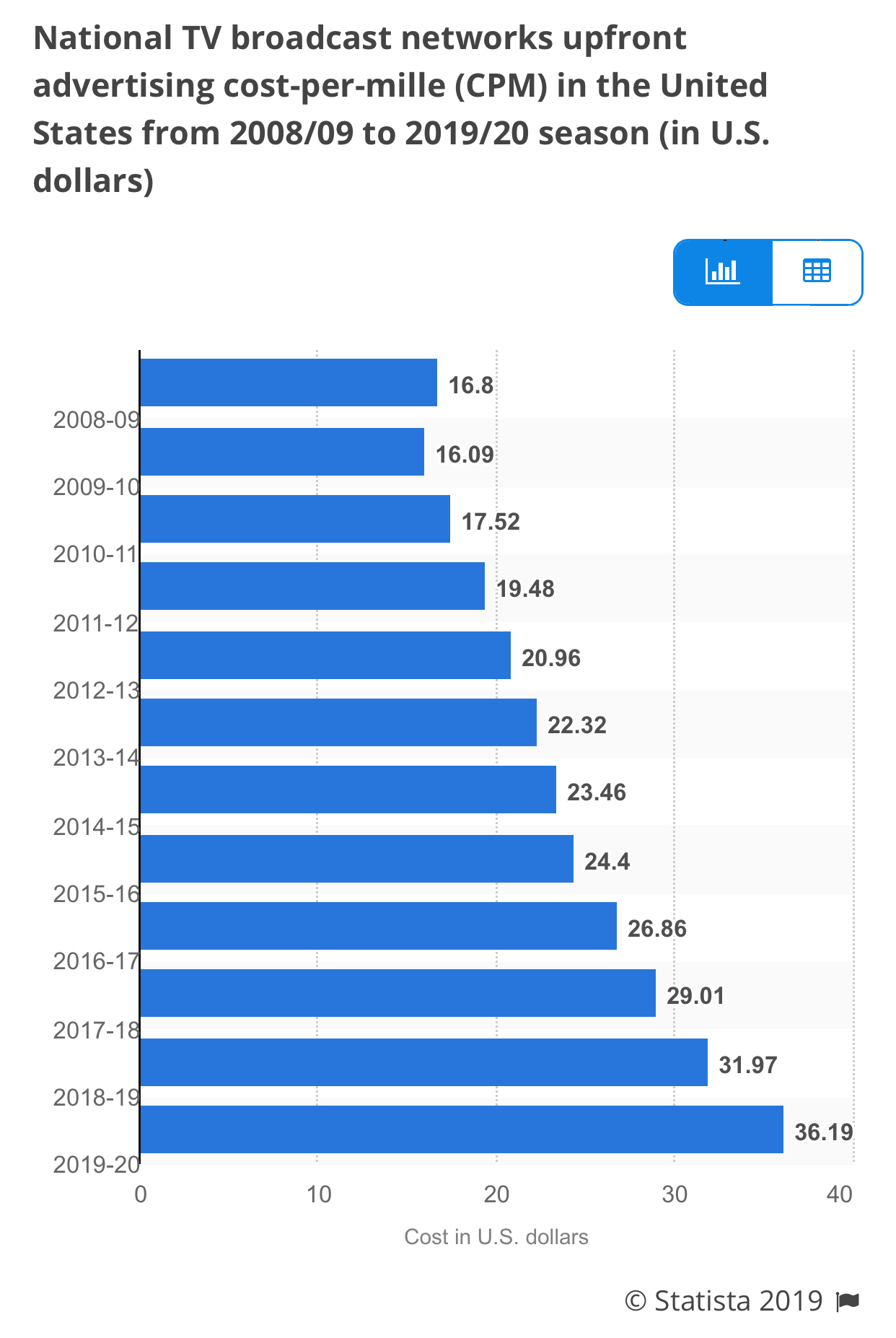

As Warren Buffett predicted, the time spent watching traditional TV has decreased compared to other forms of video such as YouTube and Netflix. However, the price of TV advertising continues to rise steadily. Expressed in cpm (cost per thousand views) for national networks:

The price of advertising goes up while the time spent watching goes down. This is a strong sign of chronic under-monetization. Advertisers realize they are making a deal despite the price increase!

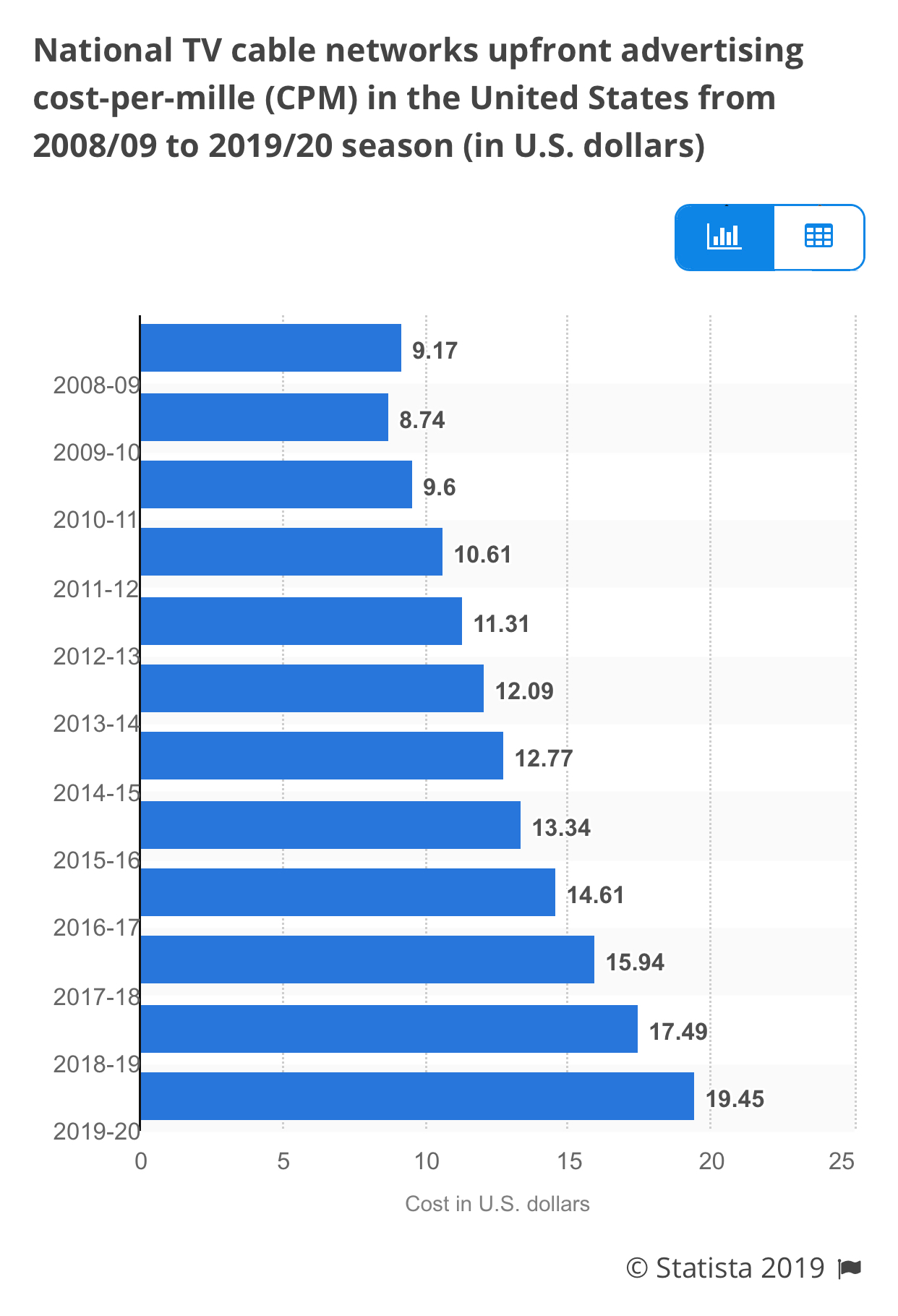

This increase is also true for cable channels despite cord cutting:

The 3% of cord cutters are more than compensated by the 7% annual price increase.

Obviously the question to ask is: what is the limit? My intuition tells me that TV is still a good deal. For this reason, look at the operating margins of Coca Cola (30%), Procter & Gamble (22%), Colgate-Palmolive (23%), Kraft (25%), etc. The reality is that TV is an excellent medium to capture your time because you don't feel it passing through: you sell it 100% without restraint.

This increased monetization of time perceptible in advertising is also noticeable in subscriptions. TV channels are asking cable operators for increasingly large retransmission fees, largely compensating for cord cutting: time remains under-represented.

Monetization over the internet

The history of the media business is also that of audience fragmentation. At the beginning of TV, there was only one channel, then two, then three, then hundreds and with the Internet an incalculable number. It is a challenge for an advertiser because collective time is worth more than individual time (the only place where man really forgets himself is in the crowd - you have to read Elias Canetti's book Crowds and Power). And when man forgets himself, we can get messages across effectively. On the other hand, individual time can be better exploited by the Internet, better targeted with a valuable feedback effect for an advertiser. So there are two contradictory trends:

fragmentation reduces the value of time by individualizing it,

fragmentation increases the value of time through better targeting and feedback.

It is the result of the two forces that will induce the tariff and it will depend on the scenarios. For FANG, fragmentation is extreme and plays in the wrong direction: the best targeting does not compensate for the negative effect of individualization: at YouTube, the cpm is around $10, at Facebook about $7. Monetization is therefore less powerful than traditional TV. However, the GAFAs are largely catching up by buying time in industrial quantities (2.8 billion monthly users on Facebook). Moreover, targeting is constantly improving with artificial intelligence and these groups do everything possible to ensure that a view brings a transaction. The monetization of time will then take a giant step forward. After the creation of @shop by Instagram, Pinterest also creates its online store, trying to monetize the user's time through commerce. From Retail Brew (27 November 2019)

Pinterest has launched a new profile, Pinterest Shop, dedicated to small retailers. The company relies on Pinterest Shop to be the cradle of e-commerce, but Pinterest Shop is only a digital derivative of the increasingly popular multi-brand concept shops.

Pinterest Shop offers 17 small American companies offering products ranging from custom light jackets to enamel pins.

Each brand has its own table where Pinterest users can browse product pins and then make purchases on the brand's website.

Retailers who wish to join the Pinterest Shop can apply via its website.

It's the season. The Pinterest boutique arrives before the small business on Saturday, November 30. In a shortened holiday sales season, it offers small traders the gift of advertising. According to Pinterest data cited by Marketing Dive, 83% of weekly Pinterest users made a purchase based on something they saw from a brand on Pinterest.

The retail sales market is much larger than the advertising market: the former is estimated at $28 trillion in 2020 while the latter is estimated at $600 billion. The Internet media have a bright future ahead of them!

What about streaming

For interactive TV (streaming), the result of the above-mentioned forces leads to better monetization: the audience can be better targeted without fragmentation reaching a critical threshold: the mass effect is still there. For example, Netflix's Stranger Things Series 3 was viewed by 64 million subscribers in the first month of its release. It's the equivalent of a box office of at least $700 million, worthy of Disney. This is why digital TV advertising rates are between 3 and 5 times higher than linear TV. The adoption of the smartphone has increased the amount of data available, artificial intelligence and consequently the monetization of time. It is extremely important to understand it when analyzing a media.

Let's take the example of Discovery, whose revenues are still 90% + dependent on linear TV. Many believe that the company has little future because of cord cutting. This is not the case because 1/the pricing of traditional advertising is rising, compensating for the effect of cord cutting, 2/ the Internet TV part is growing in parallel with the decline in audience of traditional TV and is much more monetized. The hybrid model works because time is better monetized. Roku, which is an aggregator of time spent on Internet TV, clearly shows the trend: time spent on the platform has increased by 68% over the last 12 months, advertising revenues by 79%. Not only is the time spent on Internet TV better monetized than on linear TV, but this monetization is progressing faster.

The time spent on streaming can be monetized by other means than advertising. A very effective method known in the TV world is the bundle. The principle is based on mutualisation. You are offered a service/product you really want at a lower price than you would normally pay on the condition that you take other services/products but on super-favorable terms. In the end you pay more but you make a deal on each of the services purchased. Chris Dixon demonstrated the magic of the bundle in this brillant articlet. The advantage of the bundle for the one who offers it is to receive more money and to make the customer captive of the offer. It can be seen that this strategy is increasingly being used to monetize streaming offers:

Amazon Prime is a €49 per year bundle that includes free delivery, video-on-demand (Prime Video), music, free books, etc. The grouping makes it possible to make a good deal for all Prime subscribers (important for a distributor). Time is monetized outside the traditional circuits.

Apple TV+ is a bundle with the Iphone.

Disney plus is bundled with Verizon wireless subscription.

HBO is bundled with AT&T wireless subscription.

Peacock is bundled with Flex.

The time spent watching TV on demand clearly serves other very lucrative purposes. The time market is much broader than we think.

The battle for time

Reed Hastings (Netflix) understood the problem well: the question is not the number of subscribers but the time spent on its application. Its strategy is to buy the cheapest unit of time possible (good deals being made at the time of purchase), monetization can wait. However, as Warren Buffett says, there are only 24 hours in a day. Different strategies are possible. Not every media has the need to fight on the same ground as Netflix, the intensity can supplant the quantity, especially since the smartphone induces a more interrupted use of time:

Netflix and YouTube are adopting the method of maximizing the time spent on their platform, at any time of the day or night. This requires a lot of program investment. It is a financial battle, a battle of quantity, of scale effect to obtain a monopoly on time at a very low unit price (by multiplying the number of subscribers and targeting them).

HBO or Starz will be interested in the after-dinner time that we buy with sophisticated adult programs. Subscribers, who are then in the privacy of their homes, are willing to pay to avoid advertising intrusions. These channels will try to be more original than Netflix but the unit of time will cost them more (cost of programs divided by the time spent by all subscribers). The strategy is uncertain.

Facebook is only interested in the time spent communicating. It is not necessarily very long but very profitable and can be monetized in many ways. The price per unit of time is ridiculous, the programs are free for Facebook.

Elon Musk buys some of the entertainment time of wealthy people or people hoping to be wealthy and then monetizes it by selling Tesla. For proof here (12 million views) and here (27 million views). The price paid by Elon Musk is just accepting to be a little ridiculous.

Influencers, increasingly at the source of product sales, buy your time for a little exhibition.

By extrapolating, the enormous arbitrage opportunities resulting from time capture will increasingly push any type of company to rush into it until the arbitrage is closed. Every company becomes a media that ignores itself. People's time will be less and less theirs, always busy on a screen: this will make the task of companies that are not in the media business very difficult. Media is the future.