What’s the future for Libra ?

Cemeteries are full of companies that didn’t understand the power game

From Bloomberg (October 18, 2019)

Count the chief of the biggest U.S. bank among doubters of Facebook Inc.’s effort to create a cryptocurrency.

“It was a neat idea that’ll never happen,” JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said Friday on a panel at a conference hosted by the Institute of International Finance in Washington.

JPMorgan’s Dimon participates in a panel at an IFF conference in Washington.

Dimon said the idea wasn’t particularly unique and pointed to his own firm’s stablecoin, JPM Coin. The Libra Association, the group that will oversee the digital currency, took a blow last week when several key partners, including Mastercard Inc., Visa Inc. and EBay Inc., abandoned the project.

In a wide-ranging discussion, Dimon and Morgan StanleyCEO James Gorman talked about their own firms’ technology efforts and the risks that come with those developments. JPMorgan is spending more than $11 billion this year on tech, while Gorman said his firm’s budget is $4 billion.

Two years earlier, in an interview with CNBC, Jamie Dimon had been outspoken in his criticism of Bitcoin:

Bitcoin is a fraud that will eventually explode

Jamie Dimon changed his mind a few months later, regretting his comments on Bitcoin (the price of Bitcoin had tripled in the meantime) and admitting the interest of crypto currencies. Will it be the same for Libra? Is the CEO of the world's largest bank objective when he talks about this subject or is he afraid that its domination will collapse in favour of Facebook?

The banking business

The real business of banks, as Steve Eisman explains very well in this interview , is to sell access to their balance sheet. For JP Morgan, it's a $2.8 trillion record! If there is a mandatory gateway, it is this one and J.P. Morgan charges a high price for access (Roa of 1.3% and $36 billion in annual net profit). Banks put forward two arguments to sell this access: security and speed.

The first criterion for choosing a bank is the security of the balance sheet. Accessing a fragile balance sheet can be dangerous (e. g. Lehman).

The second criterion is the security of the access path to the balance sheet: the organisation of a reliable transport system has been greatly facilitated by the development of Visa, a bank initiative. Visa is to banks what the road network is to cities. However, there are other communication channels (Swift for large amounts for example). As a result, the banking system is an interconnected ecosystem where the security of some has an impact on the security of others. Regulations operate to define a minimum level of security for each node of the network, the central bank ensures the fluidity of the whole.

After the security of stocks and flows, the second element of differentiation is the speed of processing: Wells Fargo's emblem is diligence, American Express does not bear its name by chance. A bank is measured by the speed of response to requests and instructions given to it. However, it must be acknowledged that in the age of the Internet, the processing speed is not satisfactory. How to explain that it often takes two days to establish a transfer, i.e. to produce a simple computer writing?

There is a trade-off between these two contradictory attributes: security involves control that takes time

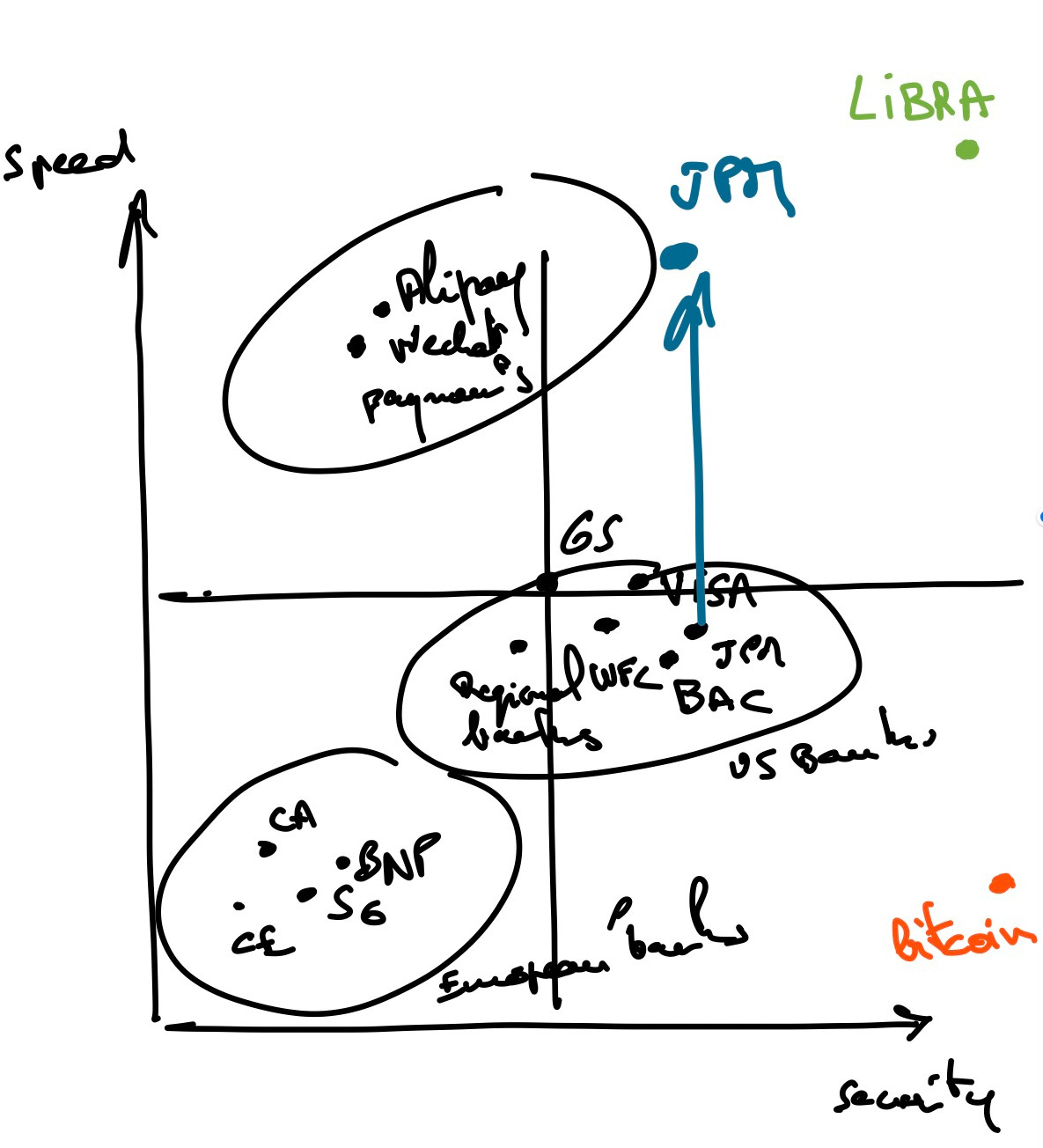

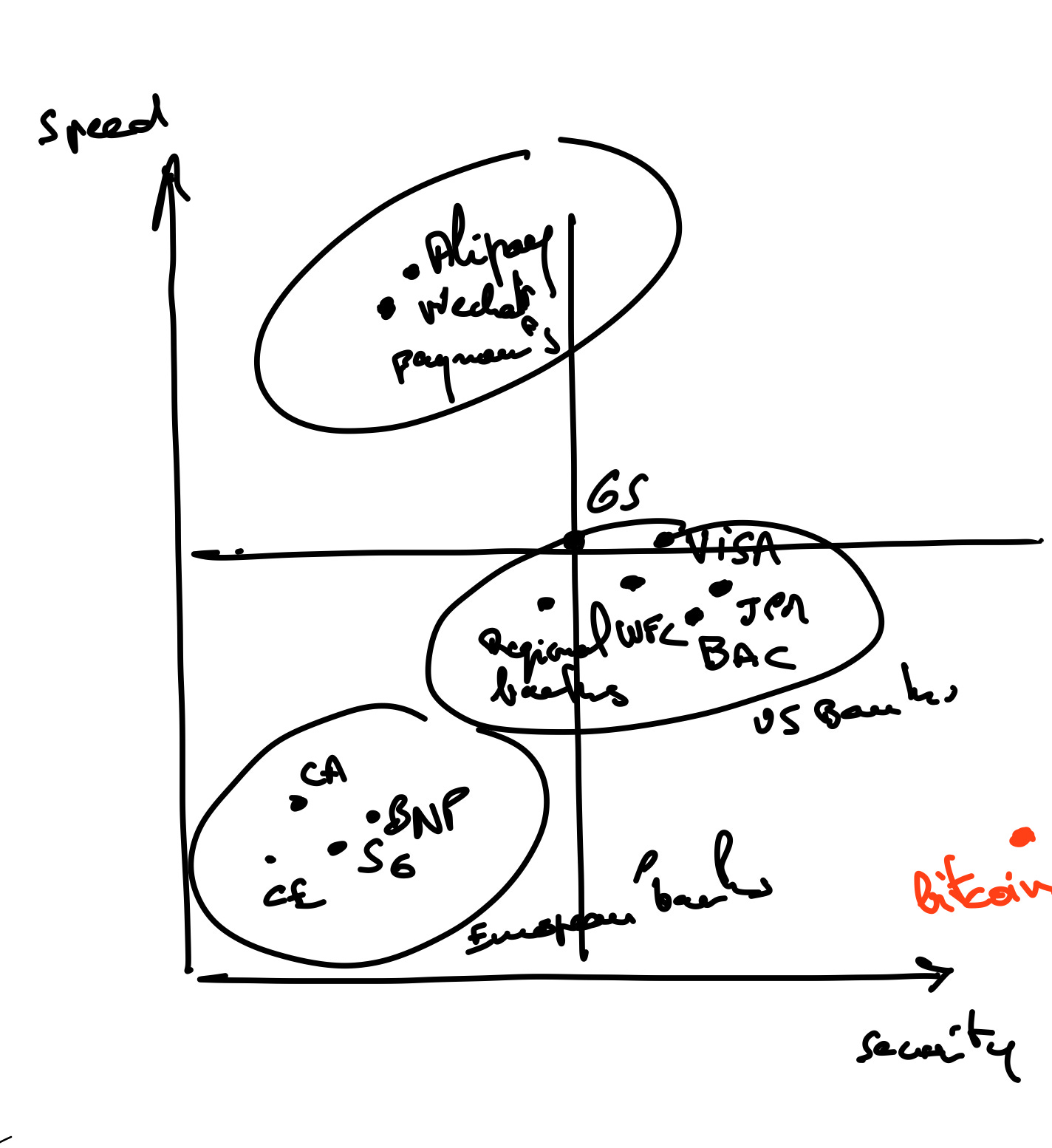

The banking system has a good degree of security, with regulation helping, but due to the interconnection and multiplier effect of credit, systemic risk exists. The stronger node will not withstand a systemic crisis of 1/10000 probability. The safety of a node, however strong it may be, depends on the whole. As a result, security and speed are not optimal. The different banks and payment systems can be placed on a graph with the security on the x and the speed on the y:

Comments: American banks sell access to their balance sheets at a much higher price than European banks, which have been selling off this access for decades. One of the best, BNP, has a 0.4% Roa ! This has two consequences:

The balance sheet of the former is therefore more secure.

US banks can reinvest part of their large profits in digitalization ($12 billion per year for JP Morgan). European banks lag behind and are competing with a horde of fintechs (N26, Revolut, etc.).

In China, Alibaba and Tencent have created two digital banks that can handle a massive amount of high-speed transactions. Alipay and WeChat Pay merge Visa and bank functionality into a single modern digital entity. Old Western payment systems are outdated. WeChat Pay processes 1.2 billion transactions per day, Visa 150,000.

The threat of crypto currencies

Alipay and WeChat Pay do what traditional banks do but in all in one, on modern IT systems (their own cloud). Their advantage is the speed. American banks are trying to catch up, creating their private cloud in particular, but they are limited by their lack of integration with means of transport (Swift, Visa, etc.). This is not very serious for them because Chinese banks are subject to a systemic risk that cannot be controlled from the West. No action by the FED can prevent such a risk. This is why US banks are relatively protected from the attacks of Alipay and WeChat Pay. Jamie Dimon prefers to keep his criticisms for a more serious threat.

Cryptocurrencies are really disruptive in terms of security. They are both storage of value (like the banks' balance sheet) and secure transport, like a photon which is both wave and matter. Bitcoin is both a value ($7,500 today) and the underlying transfer technology. Cryptocurrency is a world in its own right that bypasses banks on the major point of their differentiation: security. No need to access banks' balance sheets for financial transactions that are secured by the decentralized Bitcoin protocol. And there is no systemic risk, the level of security is higher! Represented on our graph this gives:

That explains why Jamie Dimon saw red in 2017, when Bitcoin started to make people talk about it.

Jamie Dimon and the bankers' response

The counterpart of the security provided by crypto currencies is the slowness with which transactions are validated. Bitcoin processes 7 operations per second compared to 24,000 for Visa. There is a trade-off between speed and safety. Security takes time. The Ripple, for example, relies on a limited network of financial institutions to validate transactions (without mining) and already reaches 1,500 operations per second. But security is not the same as for Bitcoin because it is based on only a few players. Generally speaking, in a blockchain, there are three ways to increase speed:

reduce the number of validation nodes: the risk is more concentrated,

increase the size of the blocks: piracy becomes easier,

reduce the mining-time: the risk of error increases

On the other hand, by accepting a level of security closer to that offered by banks today, the blockchain makes it possible to bypass intermediaries (correspondant bankers) and gain speed compared to traditional systems. JP Morgan's strategy is based on the following axes:

denigrate the most dangerous aspect of crypto-currencies, the storage of value, because this function makes it possible to do without access to the banks' balance sheets, the core business,

waving the red rag in front of public authorities who can only take a negative view of a private currency that could undermine the sovereignty of the state,

focus its efforts on what can strengthen its core advantage: the speed of access to its balance sheet. So focus on the transport side of the crypto currency to accelerate its speed (even if it is to the detriment of Visa/MasterCard in the long run: it is better to disrupt others regardless of who you are...)

thus relegating Bitcoin to the rank of a barbaric relic, unable to fluidify exchanges

JP Morgan's strategy is to access the top right of our graph, the most enviable position, and this without competition:

The creation of the JPM coin announced in February 2019 meets this objective: this stablecoin, whose value is indexed to the US dollar, is based on a derivative of the Ethereum protocol and aims to compete with the Ripple. Its function is to accelerate the transfer of institutional money (large amounts), avoiding the traditional Swift circuit. In the long term, its function may be extended to settlements between private individuals. The JPM coin is created at each transaction to take advantage of the speed of the blockchain, then destroyed at the end of the transaction. Under no circumstances may it be used as a reservoir of value and a currency of exchange. It thus differs from the Ripple by dissociating the two facets of crypto money and keeping only what reinforces JP Morgan's core business (fund transfer). At the same time, JP Morgan is doing the public authorities a service: they can be modern by approving such a project, which does not affect the sovereignty of the state.

Then, in June 2019, Facebook announced the Libra project which has the potential to overtake JP Morgan and banks more generally on the two dimensions mentioned above:

The Libra threat

Facebook has a problem with Tencent and WeChat Pay: the Visa network is dominant in most Western countries with 3.3 billion members, while in China, the Union Pay network (their largest credit card provider) boasts 800,000 cardholders. As a result of this lack, Tencent and Alibaba were able to create a highly cash-efficient integrated payment system based on QR code, which spread like wildfire among more than 500 million users each. In the West, Facebook can only be a distributor for Visa/MasterCard, one more distributor, condemned to the diktat of interchange. Mark Zuckerberg doesn't like it, he wants power (and the monetization that goes with it). The banking sector must be disrupted because its integration allows it to capture most of the value linked to money with a service that is, after all, average. We have addressed this issue here.

Clayton Christensen explains in his book The innovator’s dilemma how to break an integration: 1/ create a modular offer on a part of the chain, not perfect but cheap, better on a dimension and easy to adopt 2/ improve this offer until it becomes a mandatory gateway. This is precisely what Alipay and WeChat Pay did in China: they focused on payments, a weak point in the Chinese banking system, relied on the mass of their users to impose their very fluid solution and then based on this acquired superiority began to develop other banking services free of the frictions of traditional banks. Facebook does not have such an entry point, it has to disrupt otherwise and it has no choice but to offer an alternative to the banking system!

The most credible alternative is the crypto currency which, as mentioned above, can provide either more security (bitcoin) or more speed (JPM coin) than the current banking system, but not both. Mark Zuckerberg's challenge is precisely to win on these two dimensions simultaneously to offer a truly credible alternative to the banking system:

Security is in the protocol that guarantees stocks and transactions of Libra currency. There is no longer any need to deposit your money in the bank: the Libra is supposed to be a safe deposit box

Speed is in the fact that the database is updated at each transaction according to a consensual protocol organized by a small number of validators. The consensus of a few players makes it possible to move faster than mining... and also faster than the current banking sector, with its correspondent bankers, its multiple batches, etc..

The compromise between security and speed is dealt with by a public relations operation, not necessarily by a superiority of the code or blockchain: initially, the validation of transactions will be organized by a hundred leading institutions, a prestigious list of names (security is not really in the protocol unlike Bitcoin). To reassure, these institutions are grouped together in the Libra association in which facebook will have only one vote. Later on, the list will be opened publicly, the validation process being gradually integrated into the protocol (in proof of stake). This sleight of hand is intended to enhance Libra's safety in the eyes of the public and authorities. The idea for Facebook is to give itself time to advance technology while starting its conquest of the universal currency.

Libra: the game of fools

The idea of Libra is extremely bold and, regardless of the economic aspect, corresponds to Marc Zuckerberg's mission to restore power to the people. His speech at Georgetown University on October 17, 2019 is a testament to this:

People having the power to express themselves at scale is a new kind of force in the world — a Fifth Estate alongside the other power structures of society. People no longer have to rely on traditional gatekeepers in politics or media to make their voices heard, and that has important consequences. I understand the concerns about how tech platforms have centralized power, but I actually believe the much bigger story is how much these platforms have decentralized power by putting it directly into people’s hands. It’s part of this amazing expansion of voice through law, culture and technology.

The Internet brings the revolution that will break the collusion between the press (the fourth power) and the elites, i.e. the current power structure. In this regard, a central bank is the very example of an obscure power that does not have to answer to the people (the famous independence that was not in the initial charter-at least for the FED-); it is in Marc Zuckerberg's logic to attack the central banks and their subrogates the banks.

The main point of this monetary revolution is to make Libra a store of value, because then it will eventually become independent, especially if it is used by 2.7 billion people (number of monthly users of one of the three Facebook applications, WhatsApp or Instagram). Marc Zuckerberg is setting up a ploy:

he created the Libra association in charge of managing the protocol, made up of renowned institutions (28 at the beginning with the objective of reaching 100 at the time of creation). Obviously the banks are not participating, the project aims to destroy them. Payment systems are more ambivalent, threatened by banks that set up blockchains, such as JPM coin, and the Libra that could do without them. They decide first to try the adventure to counter the threat (they have 7 votes out of 28 at the beginning, which is not insignificant)

The association status allows Facebook to opt out from the Libra project, if governments don’t appreciate Facebook involvement. The Libra can emerge without Facebook at the start, even if it has to join after.

The institutional side of Libra aims to reassure the authorities about the ability to meet anti laundering/KYC obligations. This contrasts it with the classic crypto currencies accused of being used as a tool by bad guys.

He thus positions the Libra as the nice crypto currency against the evil Bitcoin. To make matters worse, La Libra is presented as an appendix to national currencies, unlike the Bitcoin, which highlights the lack of discipline of currency fiat. Each Libra has its countervalue in a basket of national currencies carefully kept by the Libra association. David Marcus, president of the Libra association, insists that there is no money creation, thus avoiding the main problem, namely that Libra is indeed a currency.

Finally, to de-dramatize the threat, Marc Zuckerberg claims to target emerging countries and unbanked populations in order to lift them out of poverty. What can I say to that?

States and banks united to destroy the project

Despite all this fine talk, the fact remains that Libra is a reserve of value, that it can therefore replace bank deposits and escape the mechanisms of creation and monetary regulation of central banks. Let us take a very simple example to illustrate the danger. The association's rules provide that interest on sums deposited to purchase Libra will be due to its members as remuneration. Libra is thus theoretically less interesting than the basket of currencies because it does not pay interest, unlike the latter. In a world of negative rates ($17T today), it's the opposite! There could be a surprising craze for Libra, filling the association's coffers, putting downward pressure on rates, leading to even more demand for Libra: the vicious circle that would deprive states of their sovereignty and banks of their deposits. With nearly 3 billion members, the Libra could take precedence over the dollar or the euro, indexation on a basket of currencies would gradually lose its importance until the unit of account was no longer the national currency but the Libra! At the same time, negative rates would lead the members of the association to bankruptcy, unless it devalued the Libra: a big crisis in perspective... over which the central banks would not have any control.

US bankers declared war on Libra on 16 September at a meeting with the FED. According to Bloomberg's report:

Facebook is potentially creating a digital monetary ecosystem outside of sanctioned financial markets -- or a ‘shadow banking’ system,” banks said, according to minutes of this month’s Federal Advisory Council meeting. “As consumers adopt Libra, more deposits could migrate onto the platform, effectively reducing liquidity, and that disintermediation may further expand into loan and investment services.

Feeling the wind turn, the main payment systems, already not enchanted by the Libra initiative, torpedoed the project by withdrawing from the association (Paypal, Visa, MasterCard and Stripe) and making her lose her credibility.

Politicians are pounding, following a very critical report from the G7 and then another from the BIS: the Libra is an attack on national sovereignty. It is to be expected that the regulation of stablecoins will be very restrictive.

How can Facebook get away with it?

Seeing the end coming, Facebook is trying a three-step strategy:

Agree to make several Libra (one per national currency). The project is less ambitious: instead of being based at 50% on the us dollar, 18% on the euro, 14% on the yen, 11% on the sterling and 7% on the Singapore dollar, there would be a Libra Us, a Libra euro, etc. Facebook uses the divide and conquer strategy. If only one state accepts, the project can start and then expand at a later stage (even without Facebook)

Raise the specter of China infringement on fee speech and its technological advances. Marc Zuckerberg's speech at Georgetown University has a subliminal meaning: kill Facebook and you will have the Chinese model that is already looking beyond its borders (NBA tweet case). And China intends to surpass the United States with technology!

Minimizing the Libra threat: in his opening remarks to congressional questions on October 23rd, Marc Zuckerberg states:

Finally, there is the question of whether Libra is intended to replace the sovereign currency, and whether it is appropriate for private companies to be involved in this type of innovation," he said. "Let me be clear: this is not an attempt to create a sovereign currency. Just like existing online payment systems, it is a way for people to transfer money.

Marc Zuckerberg has a certain naivety or lack of knowledge of monetary mechanisms (which is even more dangerous). From the moment a currency is exchanged in abundance, it becomes an account unit. This is unacceptable for the banking system (both Chinese and Western), because money captures the value that used to reside there and breaks the power of the state. The Libra project can only really take place if, like the local JPM, the association accepts that the money be created for transport and destroyed immediately afterwards. The Libra is in serious danger of the fate of Esperanto while the banking system will continue to prosper. Facebook may end up licensing its technology to the FED....